Italy is one of the worst cases in the western world when it comes to the coronavirus outbreak and economy lockdown. Strong repercussions were felt by all economic sectors during this crisis, digital advertising being one of them; it experienced changes in both demand and advertisers’ campaigns put into rotation.

To help marketers and advertisers better understand the ongoing trends and what this crisis actually means for them, we compiled the stats roundup for the Italian market based on our internal data from the MGID platform.

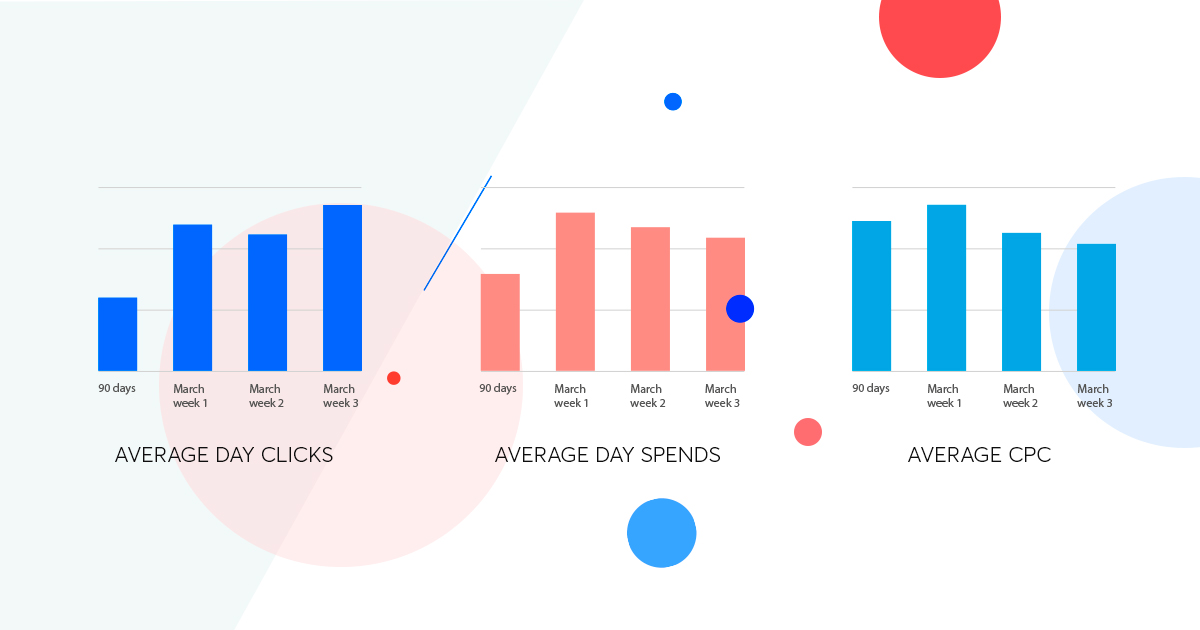

For analysis, we took the key metrics such as average CPC, average day spends, average clicks, and compared them across categories 90 days before and during three weeks of the pandemic outbreak in March.

Market dynamics

Overall, we see the substantial growth of traffic volume as users stay at home and consume more content during the lockdown. The average day clicks increased by 74%, with a still present upward trend.

Average daily spending also increased by 65% in the first week and by 34% in the third week of the quarantine period (as compared to December 2019). This can be explained not only by increased exposure to campaigns but also by shifting to online purchases and replacing offline activities with online substitutes. However, it can be noted that average daily spending gradually decreased due to the declining demand for non-essential products.

Another major effect of the economy lockdown is that clicks are getting cheaper. Average CPC rates fell by 22% in the third week of the lockdown. Basically, that means that there is a lot of opportunities to do flood advertising and win the market in the regions that are of interest to you.

Top-performing categories

Weight Loss and Options are the largest categories in the Italian market: together these verticals account for nearly half of the total spends in this region. For Weight Loss offers, average spending increased by 19% as compared to the pre-pandemic level. The demand fluctuated during the quarantine period, but overall we see sustainable growth as compared to December 2019.Average spending in the Options category also increased by 26%. The market demand in this category skyrocketed to almost 3.5 times its previous size at the beginning of March but decreased afterward, and it can be projected that soon it will be at the pre-crisis level.

The fear of Coronavirus is followed by closer attention to health issues, therefore nutra and health categories, such as Skin Care, Foot Health, Oral Care, are on the rise. Average spends for Skin Care have multiplied by 3.8x, for Oral Care by 1.7x compared to before-lockdown levels. However, this dynamics pales in comparison to Alternative Medicine offers, as average spends in this category multiplied by 17x.

Other up-and-coming niches are the pastime opportunities that fit the lockdown regime: Video Gaming, Smoking Cessation, and Home Improvement. Average spending in these categories multiplied by 2 during the lockdown.

Some of the declining niches are Automotive, Bone and Joint Conditions categories. Lower demand for the products in the Bone and Joint Conditions category can be explained by lower attention to internal human needs during this crisis. For Automotive, it may be early to decide on that matter due to the long conversion in this vertical.