BFSI (banking, financial services and insurance) encompasses a wide range of products, including but not limited to personal finance solutions; credit or debit cards; microloans, life, health and property insurance; brokerage services; cryptocurrencies and investing programs.

Native ads are a perfect traffic source for BFSI offers, with its advanced algorithms for targeting diverse audience segments and unobtrusive placements that capture user attention. Let’s dig into the details of how native advertising can help you promote BFSI in Vietnam.

Key strategies successful performance marketers do right

Spotlight brand messages and product benefits from the start

Remember, competition is fierce in this niche. Users tend to compare different packages and programs, so USPs, important information and product differences should be addressed first. For recognized brands, adding a tagline and brand logo on ad creatives can increase CTR.

Know your audience

Each BFSI product serves a specific audience — a group of people with different interests and behaviors — so it is imperative that you understand yours. For example, for lower-income groups, buying a motorbike is a significant milestone and hallmark of financial success. Therefore, a loan package targeting low-income audiences should use that information to their advantage when designing creative approaches.

Your audience’s habits and the demographic they fall into also translates into your choice of publishers for native campaigns. If the target audience is mostly low-income workers who are quick decision-makers, mid-range newspapers can be a good fit for native placements. If the target audience consists of those with a higher income, choose top-tier newspapers.

Creative tips

Emotional advertising

By tapping into strong emotions, advertisers can make consumers pay attention and connect with the people and stories in advertisements. Usually, you can draw on core emotions, like happiness, sadness, surprise or anger. For example, when promoting affordable loans, photos featuring crying or angry people with empty wallets can make users relate to these situations and consider the promoted financing solutions.

Represent diverse audience segments in ads

When users see themselves represented in ads, it can lead to a high emotional response and a boost in campaign performance. Attractive yet ordinary-looking people in recognizable daily situations work well in combination with text pertaining to income or other figures.

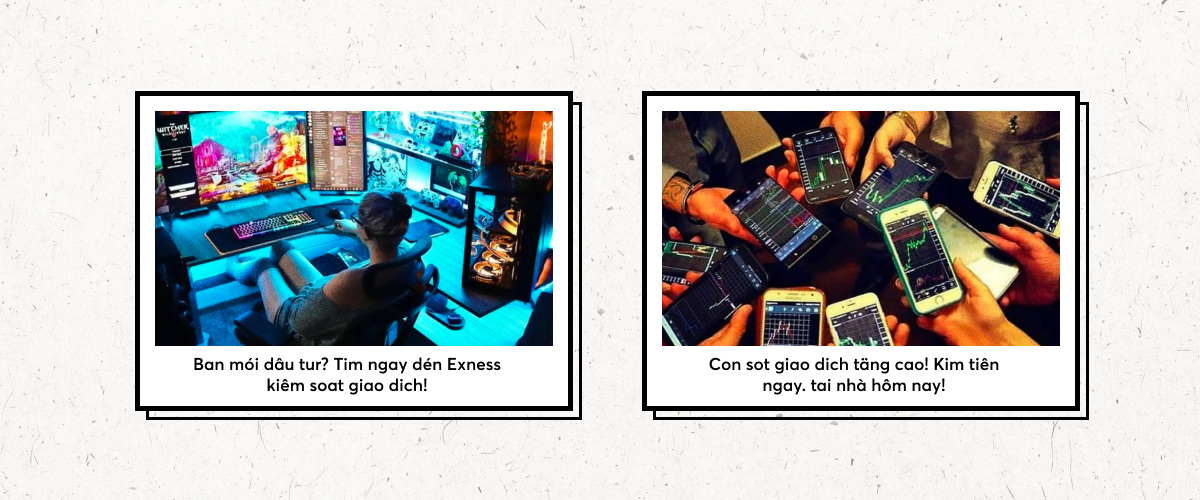

Show advanced technology

To emphasize convenience and speed, stylize ads with high-tech devices in a wash of blue light to represent the device’s screen light. If you advertise investing or trading programs, show charts on mobile screens to imply that trades can be easily managed from a phone.

Colors, unusual angles, childish illustrations and other attention-grabbing concepts

Combinations of red and blue, as well as plain yellow banners, call attention among Vietnamese audiences and give the expectation of something new and exciting. Unusual angles make users feel that something is being hidden from them, so they’ll want to take a closer look. Finally, childish illustrations present the financial product as something so easy to comprehend that even a kid could understand.

Success with MGID

Techcombank

The challenge

Being one of the largest commercial banks in Vietnam, Techcombank has strict requirements for brand safety. Ads are not allowed to contain, in any context, negative keywords based on Techcombank’s keyword list. In addition, Techcombank had experienced website loading speed issues, so campaigns had to be optimized to drive traffic at optimum capacity.

Target audience

Men and women aged 22-55 with financial needs and concerns about financial services, insurance, business, personal healthcare, etc.

Geo

Focus on 6 provinces: Hanoi; Ho Chi Minh City, Can Tho, Nha Trang, Hai Phong, Da Nang

The solution

The ads drove traffic directly to the life insurance website “An Gia Nhu Y”. With a KPI of 32K sessions, the traffic boost could reach up to 30% in order to maintain a high website loading speed. To gain better control, the campaigns were split between Mobile and Desktop traffic. After 3 days of testing, the traffic boost came to optimal values: on Desktop, it reached the target of 23%, while Mobile reached 44%.

As the campaign targeted young, mostly single people, ad creatives were designed so that targeted consumers could recognize themselves in the ads. For titles, the focus was on the product’s USPs such as: protect VND 3,000,000 per day / get 400% of insurance / sign up with only 3 questions.

The results

With MGID, Techcombank obtained more than 39K conversions, with an average CPC of $0.07 and eCPA $0.09. Techcombank reached new customers at scale across top publishers with native placements and ensured brand safety by filtering blacklisted placements.

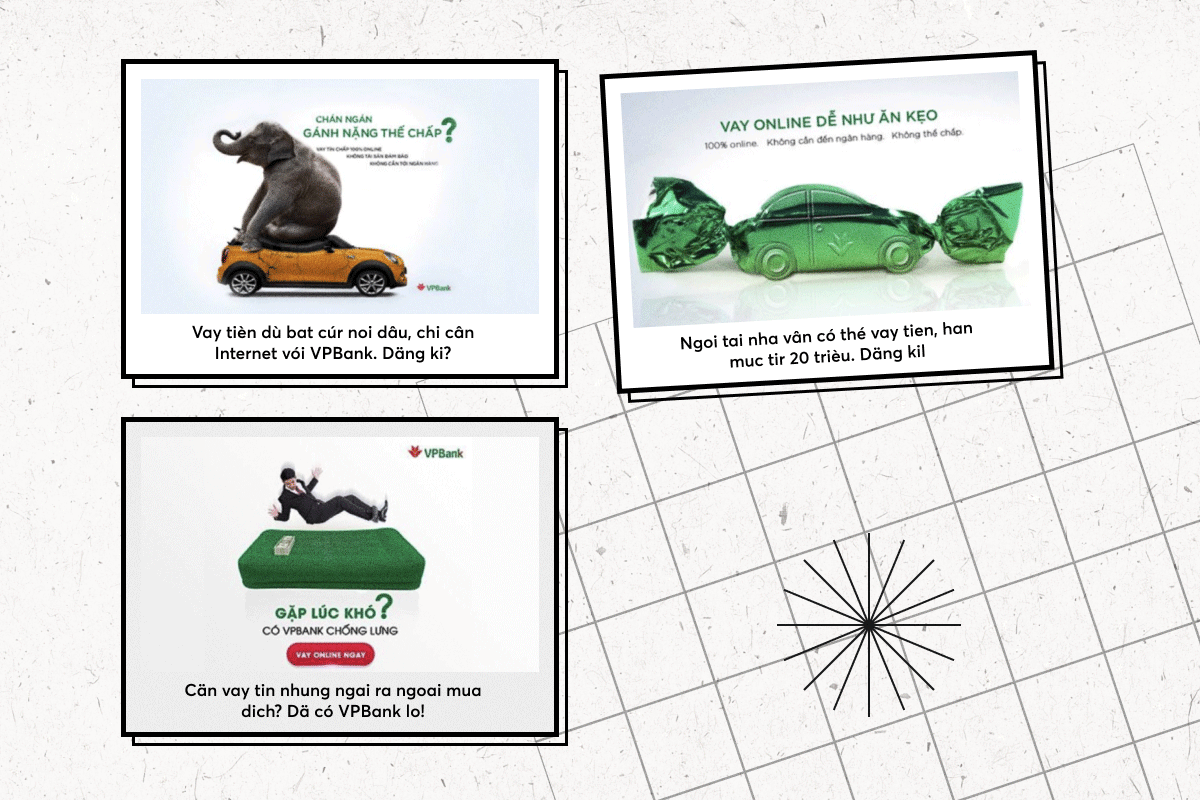

VPBank

The challenge

VPBank was looking for an efficient instrument to expand the reach of the relevant audience while keeping CPL within target.

Target audience

23-50 year old males and females looking for hassle-free loans without visiting a bank

Geo

Vietnam, focusing on Ho Chi Minh and Hanoi

The solution

To gain low CPL rates, two different campaigns were launched. The first one, a native ad campaign for mobile devices, collected data for the retargeting campaign. The retargeting campaign also used social media and search data to customize messages.

The results

The ad campaigns resulted in 1221 conversions in one month with a conversion rate of 4.85%. With MGID, VPBank obtained dCPA within the range of $1.6-2, with an average eCPA of $1.81 in the mobile first-reach campaign and eCPA $1.01 in the retargeting campaign.

Final thoughts

The finance niche has always had one of the best ROIs. And during the last two pandemic years, financial offers have remained in high demand as people became even more concerned with their financial security. While having a proven demand, BFSI is also a highly competitive vertical, saturated with quite differentiated products.

When launching a campaign, don’t forget to set up retargeting. By building a multi-channel funnel with a native ad entry point, you can warm up your audience with additional storytelling or interactive content and boost conversions in other traffic sources. However, direct selling and highlighting the product advantages from the start works the best for the majority of BFSI offers.